October 2022

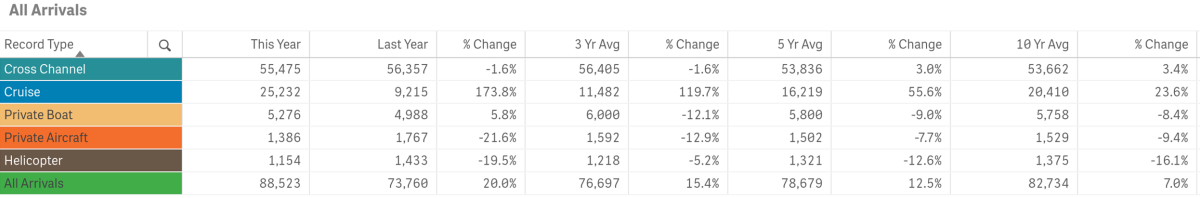

All Arrivals

October visitation increased year-over-year by 20% or 14,763 visitors

Previous tracking (below) for the month of October offers a comparison with and without COVID-19 impacts. October 2022’s total of 88,523 was above 2019’s pre COVID-19 total monthly arrivals of 78,170 by 10,353 visitors. October 2022 was below the peak visitation for the month in 2017 of 95,397.

October’s total in-bound passenger count was above the three, five and ten-year averages.

Arrivals by Sea

Passengers arriving by sea, totaled 85,983 for the month and were up 21.9% from last year.

Cross Channel Passenger counts were down year-over-year by 1.6% or a decrease of 882 people

- 2020 had the highest volume for the month @ 57,383 passengers

- 2009 had the lowest volume for the month @ 31,323

- October Cross Channel Passenger counts were below the three-year average by 1.6% but above the five and ten-year averages by 3.0% and 3.4% respectively

- Cross Channel Passengers made up 62.67% of total monthly arrivals

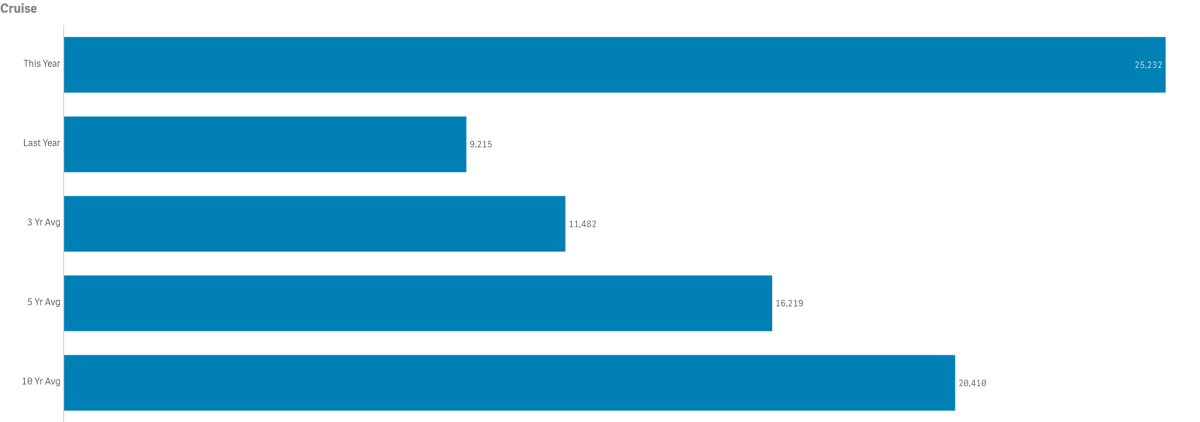

Cruise passenger counts totaled 25,232

- There were 9,215 cruise passengers in October 2021

- 2005 had the highest Cruise Passenger volume for the month @ 34,973

- 2020 had the lowest Cruise Passenger volume for the month @ 0. 2021 was next lowest at 9,215

- Pre-COVID-19 the lowest count for the month was 2010 @ 11,113

- October Cruise Passenger counts were above the three, five and ten-year averages by 119.7%, 55.6% and 23.6% respectively. Note multi-year averages are greatly impacted by the lack of cruise ships calling during COVID-19 suspension of operations

- Cruise Passengers made up 28.50% of total monthly arrivals

- The number of Cruise Ships calling on Avalon was 12

- 2017 had the highest number of ships calling @ 13

- 2020 had 0 ships call on us and 2021 had 8

Private Boater Passenger counts were up from last year by 5.8% @ 5,276 vs. 4,988

- 2020 had the highest passenger volume for the month @ 7,736

- 2012 had the lowest passenger volume month @ 4,800

- October Private Boater Passenger counts were below the three and five and ten-year averages by 12.1%, 9.0% and 8.4% respectively

- Private Boaters Made up 5.96% of total monthly arrivals

- October’s number of Vessels Anchored was up 32.1% @ 111 vs 84 last year

- 2018 had the highest number of Vessels Anchored @ 252

- 2011 had the lowest number of Vessels Anchored @ 10

- October was above the three-year average by 11.7% but below the five and ten-year averages by 12.9% and 0.3% respectively

- October’s number of Vessels on Moorings was up by 5.8% from last year @ 1,319 vs 1,247

- 2020 had the highest number of Vessels on Moorings @ 1,934

- 2012 had the lowest number of Vessels on Moorings @ 1,200

- October was below the three and five and ten-year averages for Vessels on Moorings by 12.1%, 9.0% and 8.4% respectively

Arrivals by Air

Combined in-bound air passenger counts for October totaled 2,554, down 21.9% from 3,271 in 2021.

Private Aircraft Passengers (Airport in the Sky) were down 21.6% @ 1,386 vs 1,767 last year

- 2011 had the highest volume of Private Aircraft Passengers for the month @ 1,777

- 2018 had the lowest volume of Private Aircraft Passengers for the month @ 1,161

- October’s Private Aircraft Passenger count was below the three, five and ten-year averages by 12.9%, 7.7% and 9.4% respectively.

- October Private Aircraft Passengers made up 1.56% of total monthly arrivals

Helicopter Passenger counts were down year-over-year by 19.5% @ 1,154 vs. 1,433

- 2015 had the highest volume for the month @ 1,617

- 2011 the lowest volume for the month @ 872

- October Helicopter Passengers counts were below the three, five and ten-year averages by 5.2%, 12.6% and 16.8% respectively

- October Helicopter Passengers made up 1.3% of total monthly arrivals

Lodging

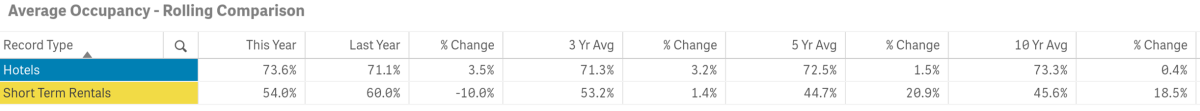

Hotel and Short-Term Rental Occupancy from Smith Travel and AIRDNA

- Hotel Occupancy for October was up by 3.5% @ 73.6% vs. 71.1% in 2021

- Hotel Occupancy was above the three, five and ten-year averages by 3.2%, 1.5% and 0.4% respectively

- Short-Term Rental Occupancy for October was down 10.0% @ 54.0% vs 60.0% in 2021

- Short-term rental occupancy was above the three, five and ten-year averages by 1.4%, 20.9% and 18.5% respectively

Competing Destination Occupancies

- Among our competitive set, Catalina ranked 2nd in Hotel Occupancy and 9th in STR Occupancy for October 2022 (high to low)

- October Hotel Occupancy was greater than Catalina’s in Santa Barbara

- October Short-Term Rental Occupancy was greater than Catalina’s in Anaheim, Huntington Beach, Monterey, Newport Beach, San Diego, San Francisco, Santa Barbara and Santa Monica

Hotel and Short-Term Rental Average Daily Rate from Smith Travel and AIRDNA

- Among our competitive set, Catalina ranked 6th in Average Daily Rate for Hotels and 3rd in Average Daily Rate for STRs (high to low)

- October Hotel Average Daily Rate was up 2.7% @ $228.94 vs. $222.91 in 2021

- October Short-Term Rental Average Daily Rate was up by 0.2% @ $553.00 vs. $552.00 in 2021

Hotel and Short-Term Rental Revenue Per Available Room from Smith Travel and AIRDNA

- Among our competitive set, Catalina ranked 6th for hotels and 4th for STRs respectively in Revenue Per Available Room (high to low)

- October Hotel Revenue Per Available Room was up 9.6% @ $173.67 vs. $158.41 in 2021

- October Short-Term Rental Revenue Per Available Room was $301.00, down 8.5% from $329.00 in 2021

Visitors Services

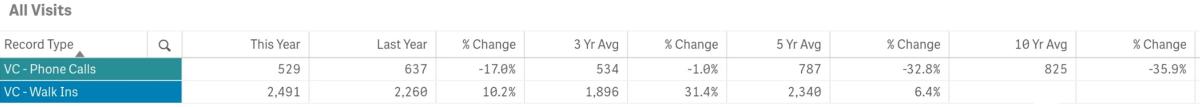

Catalina Island Visitor Center

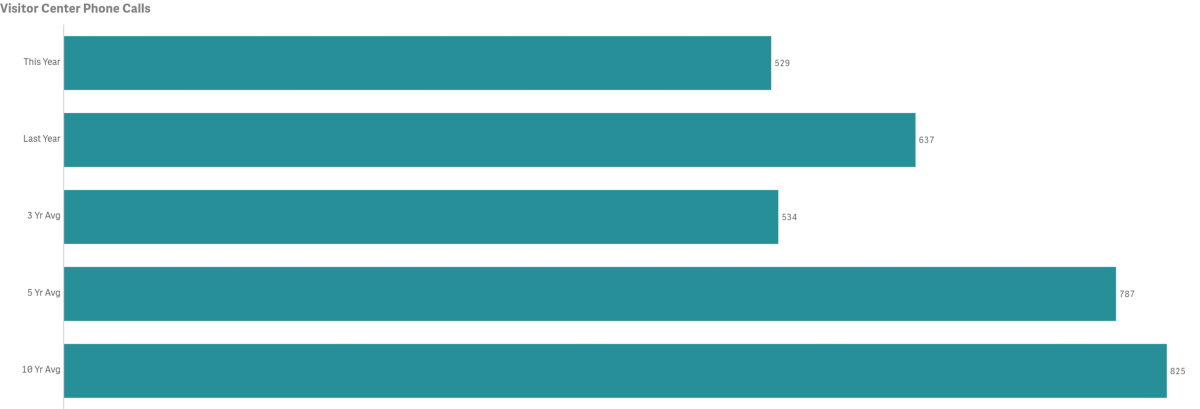

- Phone Calls for the month were down year-over-year by 17% @ 529 vs. 632 in 2021

- 2014 had the highest volume for the month @ 1,485 calls

- 2020 had the lowest volume for the month @ 437. Pre-COVID-19 2015 had the lowest volume for the month @ 462 calls

- October call counts were below the three, five and ten-year averages by 1.0%, 32.8% and 35.9% respectively

Note: phone sales for the annual New Year’s Eve Gala halted in 2019, resulting in lower call volumes July - December

- The number of Walk-Ins for the month was up by 10.2% year-over-year @ 2,491 vs 2,260 in 2021

- 2016 had the highest volume of Walk-ins for the month @ 4,648 guests

- 2020 had the lowest volume of Walk-ins for the month @ 936 guests, pre COVID-19 the lowest was 2019 @ 2,009

- October Walk-In counts were above the three-year average by 31.4% and below the five-year average by 6.4%

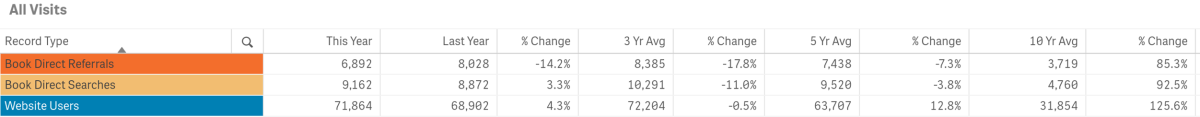

LoveCatalina.com

- October LoveCatalina.com website users were up year-over-year by 4.3% @ 71,864 vs. 68,902 in 2021

- Website users were below the three-year average by 0.5% and above the five and ten-year averages by 12.8% and 125.6% respectively

- Book Direct referrals were down year-over-year by 14.2% @ 6,892 vs. 8,028 in 2021

- Book Direct lodging searches were up 3.3% @ 9,162 vs. 8,872 in 2021

Note changes to Book Direct on member links has resulted in shifting traffic between referrals and searches

Visitor Guides & Newsletters

Note measures now include additional source tracking for months and years in which distributions were tracked

- Printed Visitor Guide orders on LoveCatalina.com @ 296, were up from 30 last year

- Online Guide downloads were down @ 113 vs. 357 in 2021

- Go California Print Guide orders totaled 135 vs 0 in 2021

- Mail House Guide deliveries were 22

- Visitor Center Guides delivered were 810

Note, no 2021 Guide was printed and 2022 guide distribution initiated in late February 2022

Some distributors tracking is running behind and will be updated as received

- New E-newsletter subscribers in October were up year-over-year @ 139 vs 102 in 2021

- New subscribers were above the three and five-year averages of 110 and the five-year average of 66 for the month

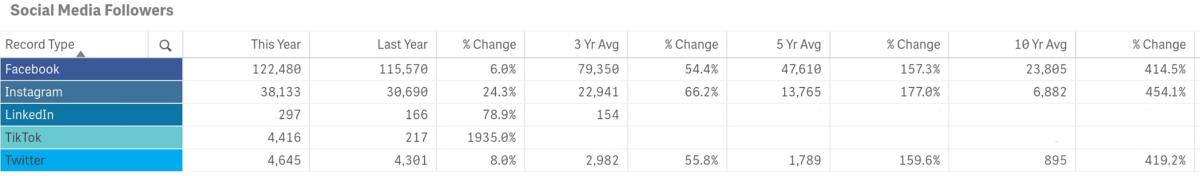

Social Media

Cumulative totals by platform as of October below

- Facebook followers are up year-over-year by 6.0%

- Instagram followers are up year-over-year by 24.3%

- Twitter followers are up year-over-year by 8.0%

- LinkedIn followers are up year-over-year by 78.9%

- TikTok is our newest platform and is up year-over year by 1,935.0%.

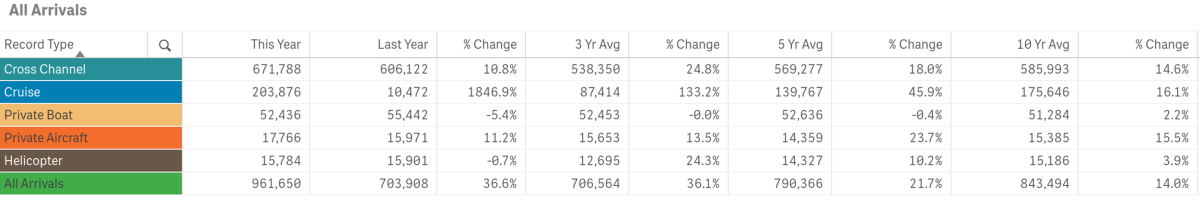

Year-to-Date Measures

Total year-to-date arrivals are up from last year by 36.6%

- Year-to-date Total Arrivals were up @ 961,650 vs. 703,908 last year or a difference of 257,742 visitors or 36.6%

- The total arrivals year-to-date exceeded the three-year average of 706,564 by 36.1%, five-year average of 790,366 by 21.7% and ten-year average of 843,494 by 14.0%

- Arrival sectors are up year-to-date except for Private Boat and Helicopter

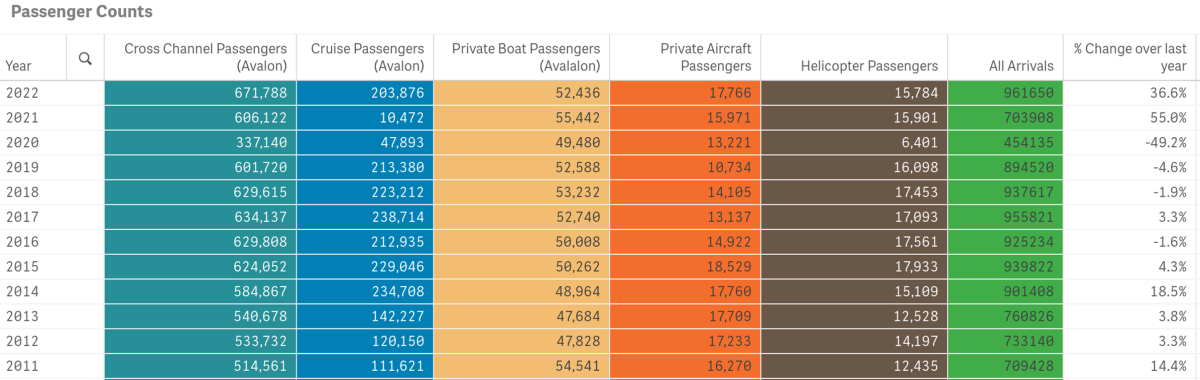

Year-to-Date—Historical Arrivals

COVID-19 and pre-Covid-19 comparison data is illustrated in the ten-year plus snapshot below (January - October combined).

- 2022 has the highest total visitation year-to-date @ 961,650

- 2020 had the lowest year-to-date total visitation @ 454,135

To view historical data for total arrivals by sector, year and month in a spreadsheet form click here. PDF File.

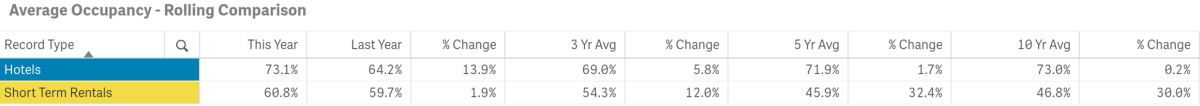

Year-to-date Lodging

Hotel and Short-Term Rental Occupancy from Smith Travel and AIRDNA

- Hotel Occupancy YTD is 731% vs. 64.2% tracked for the same time period in 2021

- Short-Term Rental Occupancy Year-To-Date is 60.8%, up from 59.7% in 2021

- According to Smith Travel, Year-To-Date Catalina’s average Hotel Occupancy of 731% was above Palm Springs, Huntington Beach, Santa Barbara, Newport Beach, Monterey, Anaheim and San Francisco. Competing destinations of San Diego and Santa Monica exceeded our year-to-date average Hotel Occupancy.

- According to AirDNA, Catalina’s average Year-To-Date Short-Term Rental Occupancy was above Palm Springs, but below all other destinations in our competitive set.

Note 2021 and 2022 rates have impacted occupancy on Catalina Island

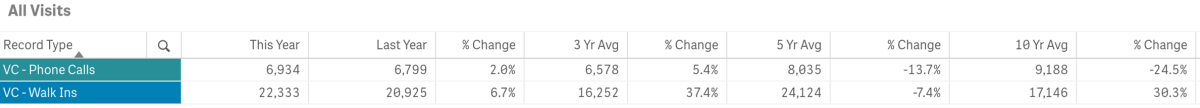

Year-to-date Visitor Services

Catalina Island Visitor Center

- Number of Phone Calls year-to-date are up by 2.0% @ 6,934 vs. 6,799

- Year-to-date Phone Calls exceeded the three-year average, but are below the five and ten-year averages

- Number of Walk-Ins year-to-date are up @ 22,333 vs. 20,925 or 6.7%

- Year-to-date Walk-In counts were above the three and ten-year averages, but below the five-year average

Year-to-date LoveCatalina.com

- LoveCatalina.com website users are up year-to-date by 4.8% @ 972,231 vs. 927,951 in 2021

- Book Direct lodging searches are down year-to-date by 11.8% @, 161,269 vs. 182,768 in 2021.

- Book Direct referrals year-to-date are down by 18.3% @ 142,693 vs. 174,679 in 2021

- Book Direct Package referrals are not currently active on our site

Note changes to Book Direct on member links has resulted in shifting some traffic to referrals vs. searches

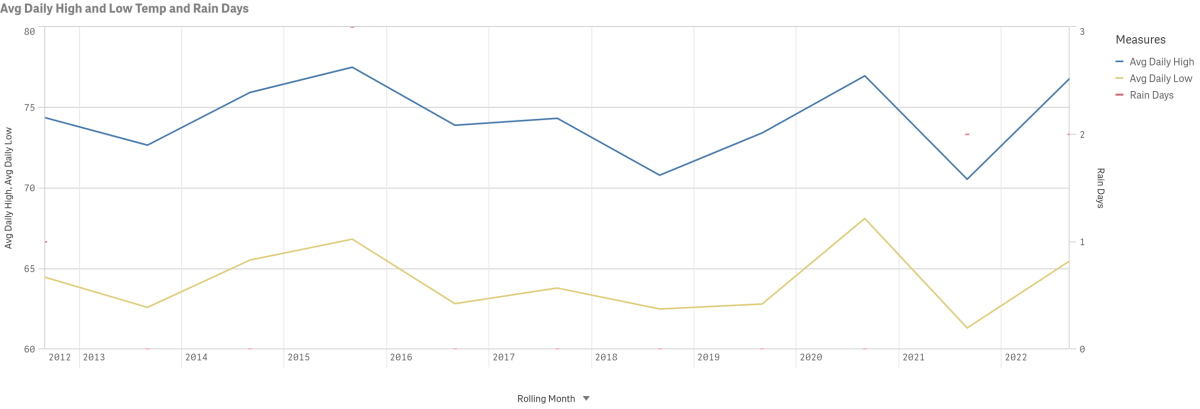

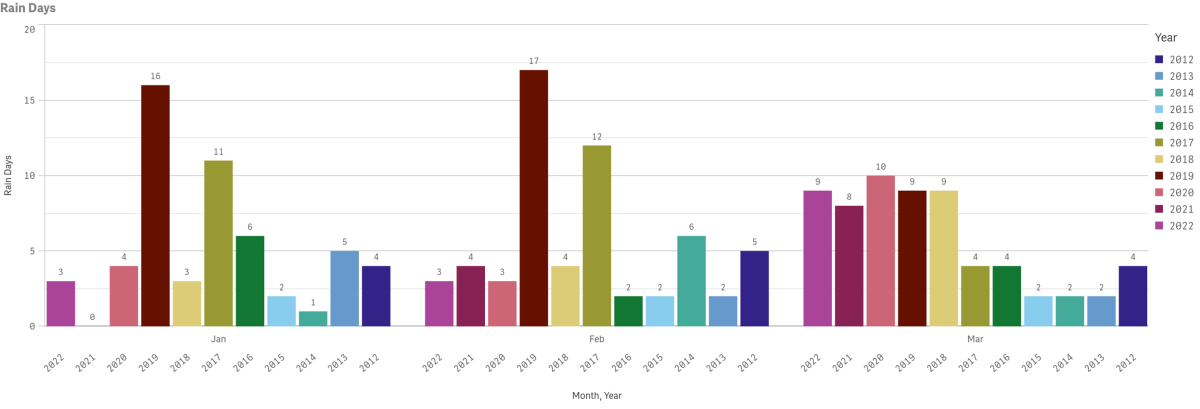

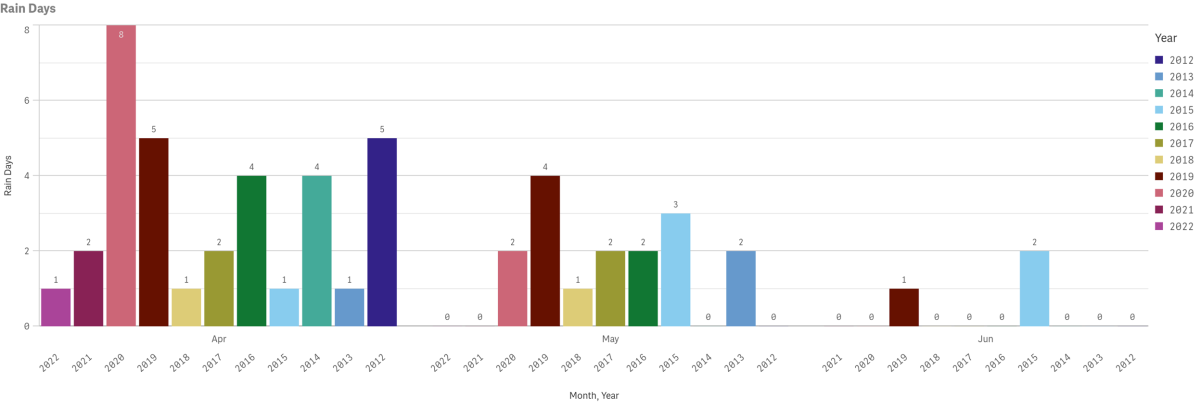

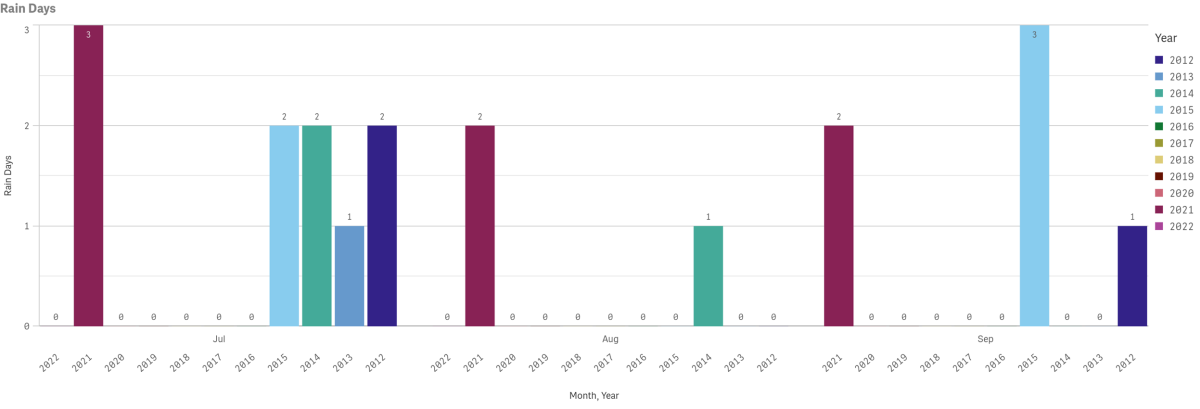

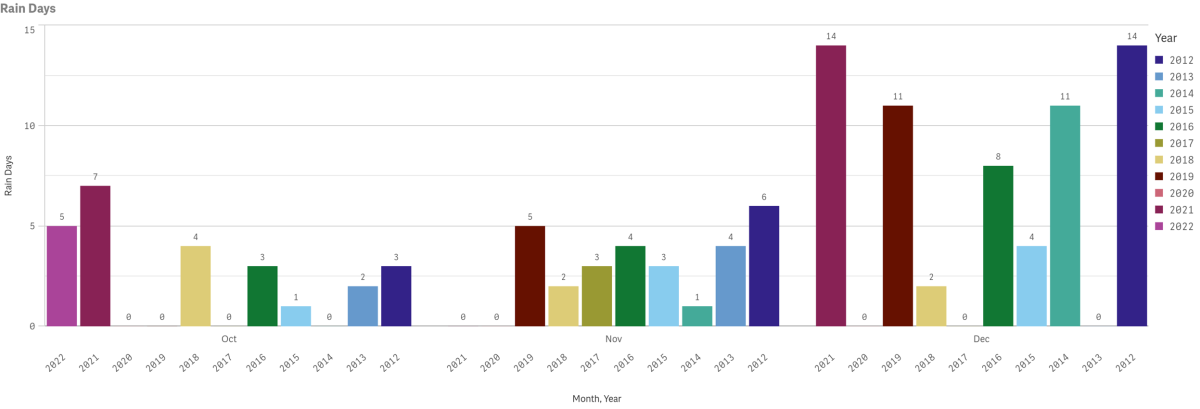

Weather

Data for October highs, lows and precipitation going back to 2012 is displayed below. Multi-year rain days data is also displayed by year and month since 2012. Measures are taken at Avalon Harbor.